Value houses with a single click!

Automated Valuation Model

Whether you’re looking to valuate your real estate portfolio, enrich your own software, verify property tax values, or generate new leads, our Automated Valuation Model gives you immediate access to automated home valuations. This ensures that you can effortlessly obtain the most up-to-date property values with a simple click.

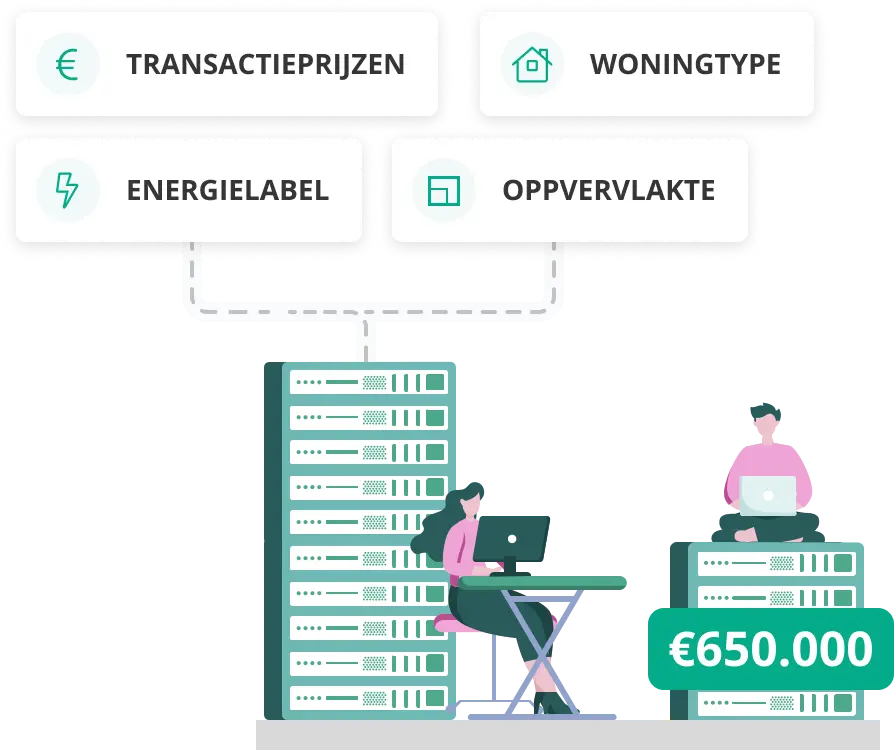

Smart data combinations for fast and accurate property valuation!

Our Automated Valuation Model (AVM) is the key to precise real estate valuations. With just one click, our AVM instantly provides the property value of an individual home or an entire real estate portfolio. Discover the power of our AVM for precise property valuations and optimize your real estate decisions today. This integration enables fully automated and highly accurate property valuations.

Wat can I use the AVM for?

- Portfolio valuation: Gain insight into the current value of your real estate portfolio

- Software enrichment: Provide your users with up-to-date property values

- Validation of property tax values (WOZ): Ensure a successful objections in advance

- Generate new leads: Offer website visitors a property valuation in exchange for their contact information

Looking for automated property valuations?

We have made our Automated Valuation Model (AVM) accessible through different ways. Home values can be obtained via a batch file, API, or PDF report. Want to know which method best suits your needs? Schedule a personal consultation and discover the ideal solution for you!

Quality assurance

When calculating a market value our AVM assumes normal sales conditions. For example, only private transactions are considered. Details such as family transactions, foreclosure sales or other outliers that could cast doubt on the representativeness of a house value are not included in our model.

To guarantee the very high quality of our AVM it is necessary that the model is continuously provided with current and reliable data. We achieve this by ‘retraining’ our model monthly with the latest real estate data. To do so, we randomly split our dataset into a training and validation set. The validation set is used after the training to avoid any sample bias. We compare the predictions to the actual transaction prices and calculate various statistics such as the mean, the median deviation and the spread coefficient.

Audit NRVT

In addition to the monthly internal test we are annually tested by the Dutch Real Estate Appraisers Register Foundation (NRVT). We have this independent assessment carried out to ensure the highest level of quality of our AVM. We think it is important that customers can trust us and we believe that transparency and verifiability are essential indicators for this.

ISAE 3402 type II certificate

With the ISAE 3402 type II certificate we once again show our customers that the outsourcing of the delivery of market values of houses is in good hands with us .

Are you interested in the possibilities?

We would like to investigate the possibilities with you. Feel free to contact Bart for more information.

Consultation

- We will contact you the same day

- Takes only 5 minutes of your time

- Without any obligations