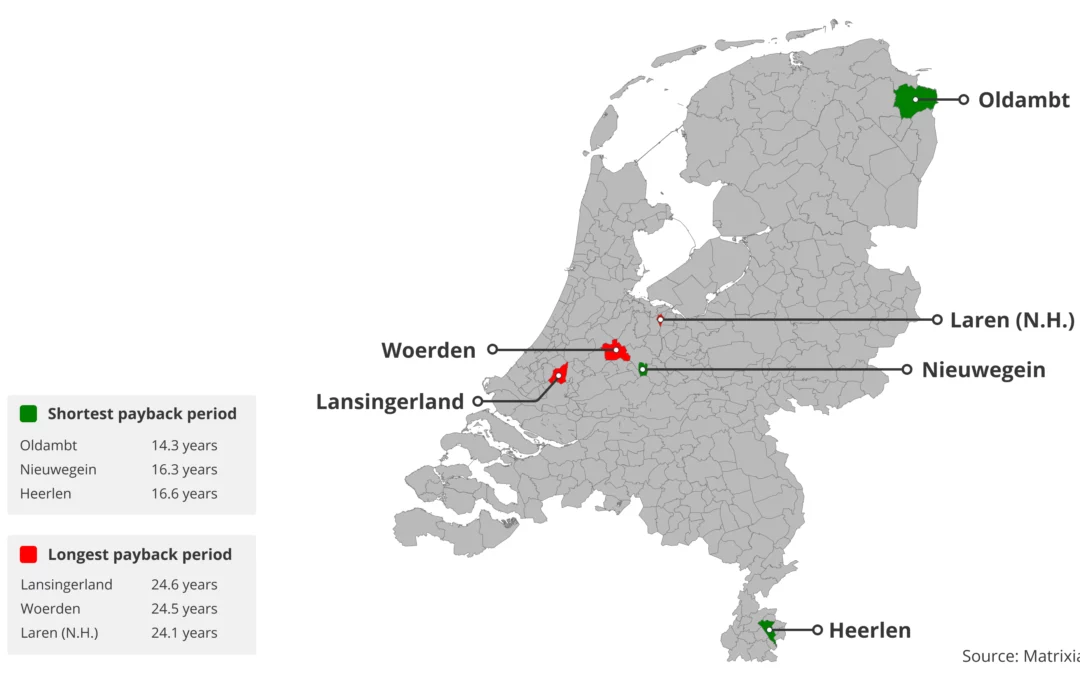

In which municipalities do landlords recoup their investments the fastest? Data company Matrixian analyzed the ratio between purchase and rental prices in the Netherlands and mapped the regional differences. The research shows that the payback period varies significantly per municipality. This overview reveals where this period is the shortest and longest.

Municipalities with the shortest payback period

In some municipalities, the gross payback period is significantly lower than in others. This means that purchase prices are relatively low compared to rental prices. The ten municipalities with the shortest payback periods are:

- Oldambt – 14.3 years

- Nieuwegein – 16.3 years

- Heerlen – 16.6 years

- Vlissingen – 16.8 years

- Terneuzen – 17.2 years

- Schiedam – 17.4 years

- Lelystad – 17.5 years

- Rotterdam – 17.7 years

- Deventer – 17.8 years

- The Hague – 18.1 years

Oldambt stands out as the municipality with the shortest payback period, just 14.3 years. This means that, based on the purchase and rental price per square meter, it takes an average of 14.3 years to recoup the initial investment of purchasing a home through gross rental income. The same applies to other municipalities on the periphery, such as Heerlen (16.6 years), Vlissingen (16.8 years), and Terneuzen (17.2 years). Additionally, we observe a short payback period in less desirable suburbs of major cities, such as Nieuwegein (16.3 years), Schiedam (17.4 years), and Lelystad (17.5 years). These municipalities are close to larger economic centers but are often overlooked by buyers in favor of the larger and more popular cities nearby.

“What these municipalities have in common is that the ratio between purchase price and rental price is relatively attractive,” says Rody Bottelier, housing data expert at Matrixian. “In these regions, home prices are relatively low, while rental prices are proportionally higher. This can mean a shorter payback period, although factors such as maintenance costs, financing conditions, taxes, vacancy rates, and local regulations also play an important role.”

Municipalities with the longest payback period

In some municipalities, it takes considerably longer for a home to earn back its value through rental. The ten municipalities with the longest payback periods are:

- Lansingerland – 24.6 years

- Woerden – 24.5 years

- Laren (Noord-Holland) – 24.1 years

- Heemstede – 23.8 years

- Diemen – 23.7 years

- Zeist – 23.5 years

- Veldhoven – 23.4 years

- Oegstgeest – 22.8 years

- Gooise meren – 22.7 years

- Amsterdam – 22.7 years

Many of these places are located in or near the Randstad, close to large cities. The attractive location has driven up purchase prices, partly because many home buyers – with or without equity – have moved from the city to these areas. This has put further pressure on the purchase market, while the demand for rental properties in these municipalities has remained more limited.

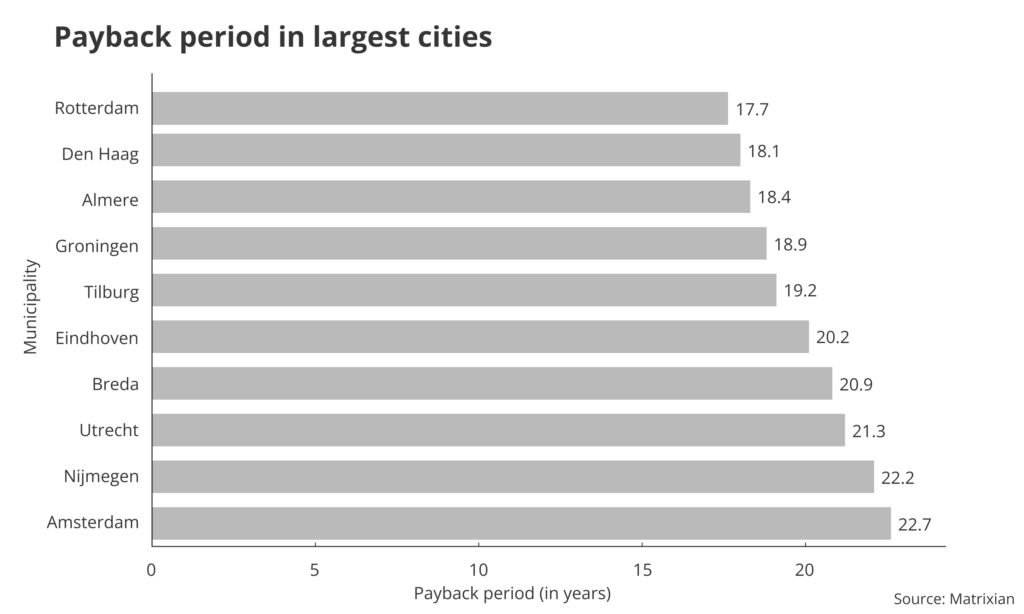

Payback period in major cities

Even within the ten largest cities in the Netherlands, there are significant differences. Rotterdam has the shortest payback period at 17.7 years, followed by The Hague (18.1 years) and Almere (18.4 years). On the other hand, Amsterdam has the longest payback period at 22.7 years, followed by Nijmegen (22.2 years) and Utrecht (21.3 years).

This trend reflects developments in the Randstad, where purchase prices—especially in Amsterdam—have risen more sharply than rental prices in recent years. As a result, the payback period in the capital is longer than in cities such as Rotterdam and The Hague, where the ratio between purchase and rental prices is more favorable.

The relatively short payback period in Rotterdam (17.7 years) contrasts sharply with the longer payback period in cities like Amsterdam and Utrecht. This is likely due to the larger housing stock in Rotterdam, where relatively affordable homes can still be found compared to Amsterdam, Utrecht, and Haarlem.

What do these differences say about the housing market?

The variation in payback periods highlights that the ratio between purchase and rental prices differs significantly per municipality. In some regions, particularly outside the Randstad, rental prices are relatively high compared to purchase prices, resulting in a shorter payback period.

Conversely, in municipalities where purchase prices have risen more sharply than rental prices, the payback period is longer. This is especially evident in cities such as Amsterdam and Utrecht. The turnaround time for finding a tenant in major cities is, of course, shorter than in rural municipalities.

“It’s good news for buyers that there are still interesting opportunities outside the big cities,” says Bottelier. “Those looking for a home to live in or rent out should consider looking beyond the traditional hotspots.”

Note: This analysis provides insight into the ratio between purchase and rental prices per region, a key factor in real estate investments. Naturally, other factors also influence the overall profitability of real estate investments, such as maintenance costs, financing conditions, and local regulations, which can impact the exact payback period.