Recent reports show that private investors are selling real estate ‘en masse’. The uncertainty about the regulation of the rental market and tax changes have put pressure on the supply on the open rental market and caused rents to rise faster. At the same time, this means that the payback period for real estate has become more favorable: people have to pay less for the purchase of real estate, but the rental income is higher. What does this mean for the investment game? And are there specific areas in the Netherlands that this makes extra attractive?

The lowest gross payback period will not be found in Amsterdam

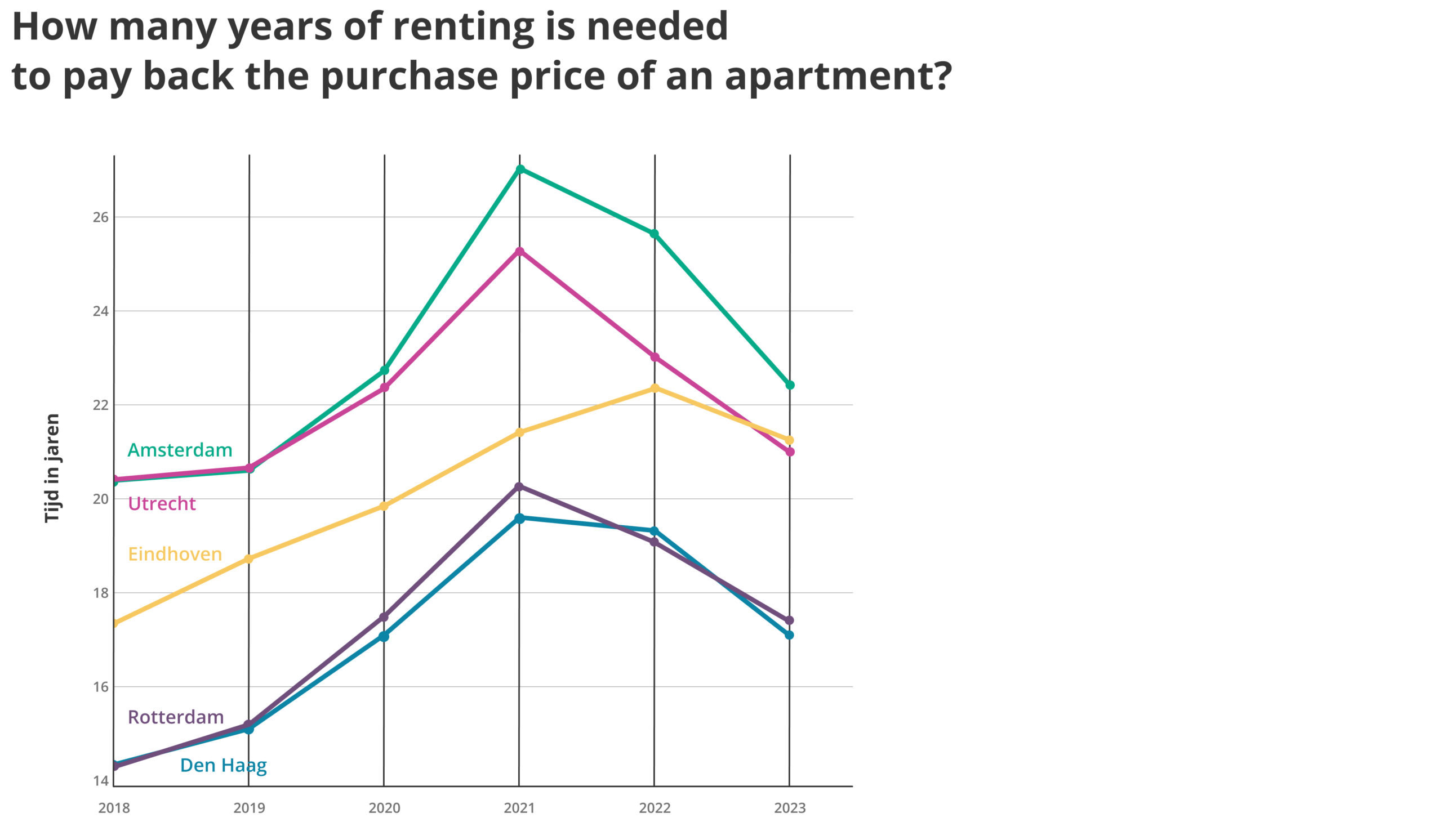

Our research shows that the lowest gross payback period is not in Amsterdam. By this we mean the number of years it takes to recoup the initial purchase price through rental income. Tax expenses, maintenance and the increase in value of real estate are not included. In addition, we specifically focused on homes that are often purchased by investors, which are mainly apartments.

The rent in Amsterdam is obviously a lot higher than in the rest of the Netherlands. But so are real estate prices. However, the proportions are a lot more favorable in other cities. In The Hague, the annual rental price for one square meter was 222.90 euros, with a transaction price of 3750 euros per m2. The number of annual rental income required to recoup the transaction price therefore amounts to 16.8 years. In Amsterdam this is considerably higher, with current market prices it will take 22.3 years there.

Does this lead to a flight to other cities?

Our figures show it does not. The overall volume of investors purchasing real estate has indeed fallen. But we do see that if we look at the investments made in the 10 major cities of the Netherlands, Amsterdam’s share has actually increased.

A choice of safety?

The crucial question remains whether investors are missing opportunities by clinging to the security of the housing market in Amsterdam, despite the long payback period. Might it be wiser for investors to consider looking at cities such as Rotterdam and The Hague, where the payback period is almost six years shorter?

Knowledge is power.

At Matrixian we understand the importance of informed investment decisions. That is why we offer you insight through accurate real estate data. Discover how our expertise can help you identify the right investments and grow your portfolio. Contact us today for a consultation!